40+ years of CX mastery

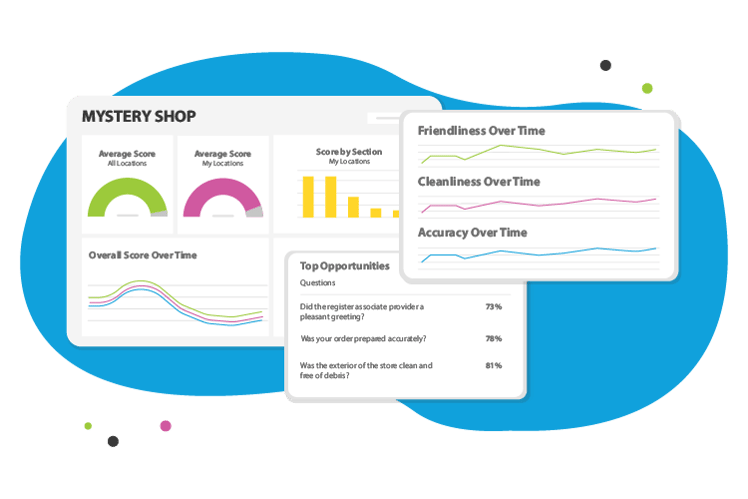

Our Mystery Shopping solution is designed based on years of hands-on expertise measuring brand service standards.

Our Mystery Shopping solution is designed based on years of hands-on expertise measuring brand service standards.

Our suite of solutions seamlessly bring Mystery Shop data together with other CX metrics to give you a complete picture.

Intouch is the most technologically advanced mystery shopping provider, delivering deep insights to drive action.

With a vast network of shoppers, Intouch Insight offers the most promising on-time completion rate in the industry.

Our programs are designed to help you meet customer expectations and deliver consistent experience across locations.

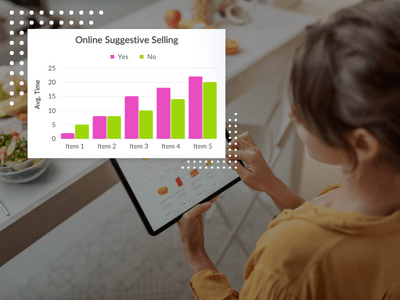

Deliver on your brand promises by measuring key metrics across all channels no matter how customers engage with you.

Intouch Insight serves some of the top multi-location brands across North America in retail, restaurants & fast-casuals, grocery, petro-convenience, hospitality, finance, and automotive, to name a few.

See how can we help you in under 90 seconds.

Mystery shopping is an essential program for multi-locations businesses who want to build a customer-centric culture. Intouch Insight designs one with your needs in mind, going beyond the basics of data collection.

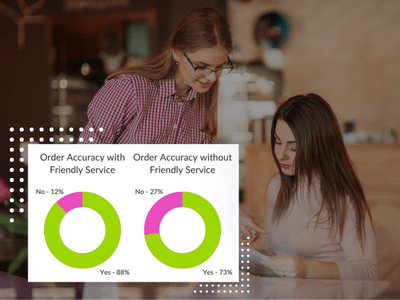

Enrich your Mystery Shopping data with other CX metrics. Easily integrate data from a Voice of Customer program or operational inspections.

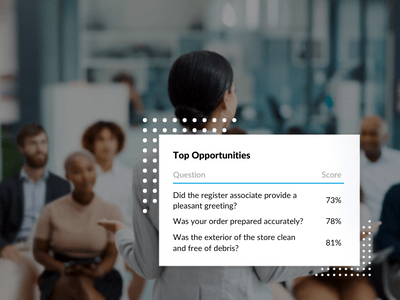

Automatically identify locations that consistently perform well or under over time to boost productivity, streamline processes, and automate feedback.

Our intelligence platform centralizes all your cx data to drive actionable insights across all your locations so you can leverage intel like never before.

Conduct deeper analysis without manual effort by automatically enriching your data with key attributes so you can easily segment and compare results.

Our highly trained team reviews all field data before it enters the platform so you can drive business decisions with confidence.

Get away from a one-size-fits-all approach. We help brands develop programs that deliver on your unique needs - on time and to your standards

Multi-location businesses have limited visibility into how frontline workers across different locations implement their brand standards. We understand that you cannot be everywhere at once; that is why our network of over 1 million experienced mystery shoppers do the legwork for you.

As one of the largest mystery shopping providers in North America, Intouch has the knowledge and expertise to build custom programs that are delivered on time, meeting high quality standards.

Adherence to customer experience standards and operating procedures can differ dramatically from location to location. With Intouch Insight, you can:

If employees lack the know-how to properly execute daily operations, additional training may be required to close that gap. Intouch Insight’s mystery shopping services can help you:

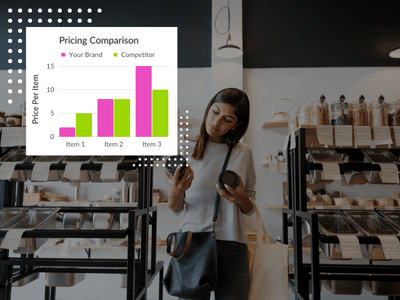

Uncover what differentiates you from the competition from a customer experience standpoint to uniquely position your brand. Intouch Insight’s mystery shopping services can help you:

Gather objective data from every customer touchpoint to drive insights on how to improve experiences at every stage of the journey. With Intouch Insight, you can:

Our blended approach to customer experience measurement delivers not just data, but actionable insights in a powerful CX platform. Powerful automations and integrations ensure you can analyze your results faster than ever before, and drive action in real-time.

Intouch continues to be a trusted and valued partner at Parkland. The actionable data provided by the mystery shopping and age verification programs helps us understand our customer experience standards and identify areas for growth and training.

Intouch Insight has been a valued partner in these efforts, helping us implement a variety of underage use prevention programs, including bolstering our age-verification capabilities and expanding our mystery shop program at retail.